BASIC CONCEPT OF FUND

BASIC CONCEPT

Experiences, Achievements and Network

Next Capital Partners, established in 2005, is a fully independent Japanese PE fund manager.

We have invested in many companies and improved their corporate value. Our team members, including Mr. Tateishi, CEO, formerly acted as Managing Director at Industrial Revitalization Corporation of Japan ("IRCJ"), consist of CPA, financial, consulting and manufacturing professionals who worked in related industries.

We also have an outside network of professional human resources in various fields.

We take the most appropriate approach to revitalize our investees by utilizing these resources.

Hands-on Approach

As a typical example of management support, we send management staff to investee companies on a full-time basis and also place external directors who provide the advice and support to the management.

We emphasize to proceed rapid and accurate decision making together with the management team; holding weekly management meetings as an example.

We use our skills and experience to provide our own hands-on services, and if necessary, also engage a professional consultant utilizing our external network.

Companies to be invested

The basic economic power of Japan exists in the huge number of various small and medium-sized companies. Some of them are suffering from bad performance although they have excellent markets and/or technologies.

Our mission is to provide them with a new source of capital and management support so that they will revitalize themselves and grow again.

Therefore, our main investee will be small and medium-sized companies requiring turnaround, restructuring, a successor, a new market and/or business which has a potential for growth and development through our hands-on support.

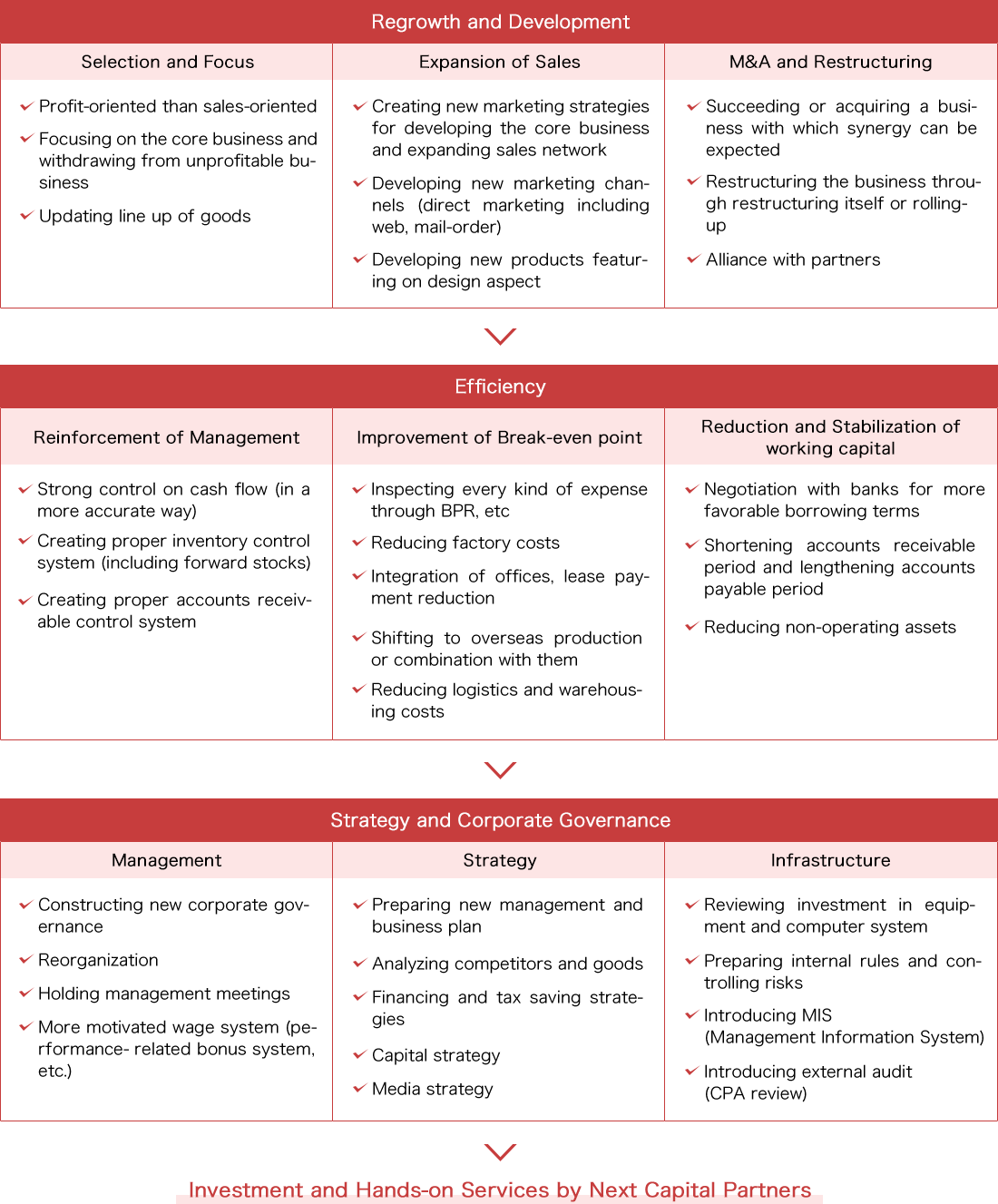

STEPS FOR THE IMPROVEMENT OF CORPORATE VALUE

<Example>

We have implemented various turnaround methods.

The following table provides an example of strategies Next Capital Partners have successfully deployed in the past: